Investment incentives in Vietnam – what are they? What makes Vietnam an attractive destination for foreign investment?

The simple answer to these questions are reduced corporate income tax (CIT) rates in conjunction with favorable cost reduction incentives. Essentially, investments incentives in Vietnam are categorized into profit-based incentives and cost-based incentives. These incentives are awarded based on the geographical location of the project, sector of investment and its impact on the local overall socio-economic development. The best corporate income tax incentive currently offered is 4 years of CIT exemption, 50% of the applicable tax rate for the next 10 years and 10% CIT for the remaining life of the project.

1. Categories of investment incentives in Vietnam

| Incentives Type | Incentive description | Eligibility |

| 1. Profit based incentives | Tax incentives on income earned | Select/ encouraged industries or social enterprises operating in designated locations or in difficult socio-economic areas |

| 2. Cost-based incentive | Special allowances & fee waivers (including import duties & indirect taxes) | Select/ encouraged industries or social enterprises operating in designated locations or in difficult socio-economic areas |

To see an easy-to-follow link on the investment incentives available in Vietnam and corresponding conditions visit our LinkedIn page or click here.

2. Criteria for investment incentives in Vietnam

i. Location based incentives

This criteria essentially covers two categories

| Geographical based | Tax incentives are granted in “encouraged areas”, including districts and towns in 53 out of 63 provinces in the country. |

| Designated area based | In addition to geographical location, companies located in high-tech zones, economic zones, industrial parks and export processing zones established under the decision of the Prime Minister are also entitled to additional corporate income tax incentives. |

The following is a list of “encouraged areas” in Vietnam:-

| Provinces classified as encouraged areas/ extremely disadvantageous | PCI 2017** | PCI 2019** |

| Gai Lai | 57.52 | 65.34 |

| Ca Mau | 56.36 | 64.10 |

| Bac Kan | 54.6 | 62.8 |

| Ninh Thuan | 57.1 | 64.8 |

| Son La | 55.49 | 63.3 |

| Bak Lieu | 57.66 | 66.7 |

| Dak Nong | 53.63 | 60.5 |

| Lam Dong | 58.66 | 66.23 |

| Kon Tum | 56.27 | 63.54 |

| Kien Giang | 60.81 | 64.99 |

| Dak Lak | 58.62 | 64.81 |

| Hau Giang | 57.82 | 64.14 |

| Dien Bien | 56.48 | 64.11 |

| Ha Giang | 55.4 | 62.02 |

| Soc Trang | 60.07 | 63.70 |

| Cao Bang | 52.99 | 63.69 |

| Lao Cai | 63.49 | 65.65 |

| Lai Chau | 53.46 | 59.95 |

The following is a list of economic zones by province:-

| Economic zones by Province | Nos of designated industrial zone | |

| An Giang | 3 | |

| Binh Duong | 29 | |

| Binh Phuoc | 9 | |

| Binh Dinh | 5 | |

| Bach Ninh | 13 | |

| Can Tho | 6 | |

| Hanoi | 14 | |

| Hai Duong | 10 | |

| Hai Phong | 4 | |

| Long An | 24 | |

| Quang Nam | 4 | |

| Quang Ninh | 7 | |

| Ho chi minh city | 18 | |

| Tay Ninh | 5 | |

| Vinh Phuc | 10 | |

| Da Nang | 6 | |

| Dong Nai | 31 |

ii. Industry based incentives

Industries in any sector employing state of the art technology, high-tech manufacturing, science and technology R&D and related work are also eligible for investment incentives.

iii. Scale based incentives

This criteria essentially covers two categories

| Capital investment | Any project in which the capital investment is greater than USD 275 million and the minimum amount of at least USD 275 million is disbursed within 03 years from the day on which the investment registration certificate or decision on investment policies is issued. |

| Company Turnover | Any project in which the gross turnover is greater than USD 400 million within 03 years from the day on which the investment registration certificate or decision on investment policies is issued. |

| Number of employees | Any investment project in a rural area that employs at least 3000 workers in a span of 3 years. |

iv. Incentives for special sectors

Tax incentives are also granted to 30 encouraged business sectors and 27 especially encouraged business sectors as classified by the government. A broad classification of these sectors is listed below.

- Industries involved in manufacturing – using state of the art manufacturing technologies

- Energy – related to clean, renewable energy or energy saving products

- Precision engineering – Developing anciallary machinery for argirculture, car parts, ship building, textile and garments, leather and footware

- IT – developing IT products

- Agro – Involved in agro based businesses

- Waste management – Involved in envoirmental services

- Infrastructure development – Involed in PPP projects in infractructure development and public transport

- Education

- Healthcare

- Sports and cultural development

- NGO’s in social development activities

- Finance – Microlending instituions

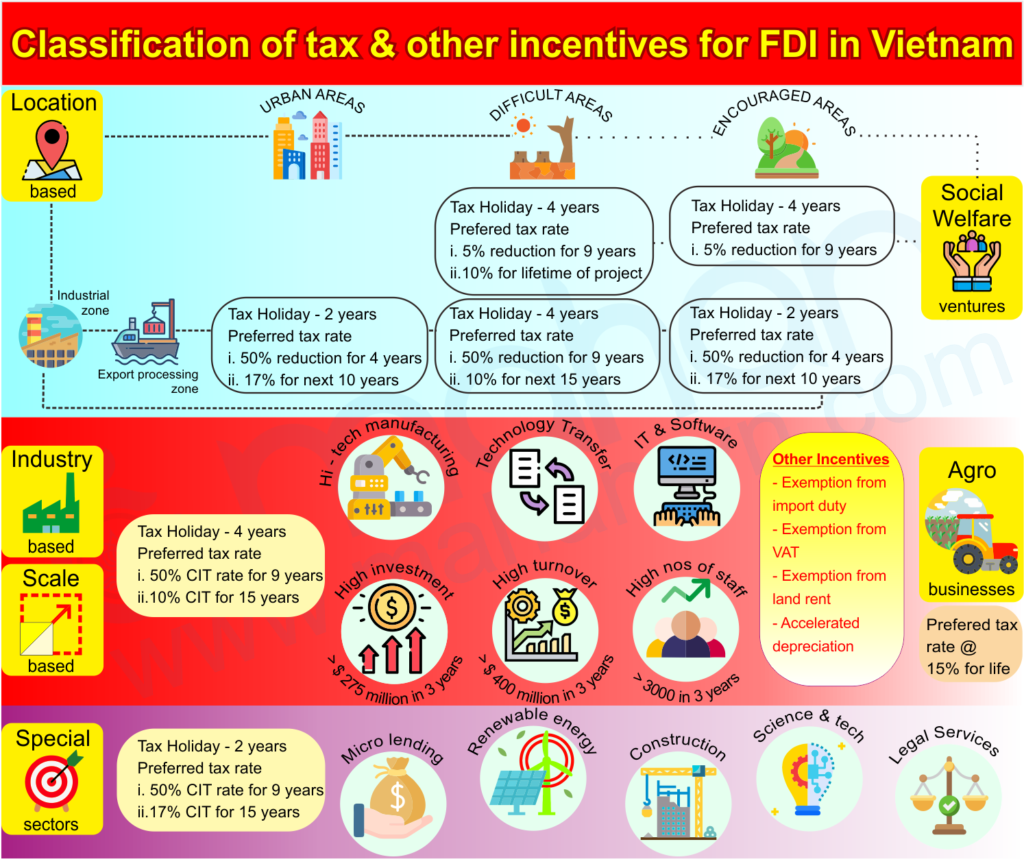

3. Infograph of tax and other incentives for investment in Vietnam

4. Comparision of investment incentives in Vietnam Vs. other countries in S.E Asia

Comparison across investment incentives between the Philippines, Indonesia and Vietnam shows that Vietnam offers the best incentives to foreign investors in S.E Asia. The key areas where Vietnam scores higher are in tax exemptions offered, reduced CIT rates, carrying forward of losses, investment allowances in the form of tax credits, reduced VAT, VAT exemption and land tax exemption.

Additionally, out of the 3 countries, Vietnam has the highest sustained annual GDP growth rate which means that industries typically enjoy higher economic growth. Other factors where Vietnam scores better are related to stable governance due to its one-party political system, a young and skilled workforce that requires minimal training, a low minimum wage which increases competitiveness in product manufacturing, a strong legal framework to protect patents and intellectual property and lastly, an open market policies in the form of free trade agreements.

| Form of incentive | Vietnam | Phillippines | Indonesia |

| 1. Tax exemption | Tax exemption: for income from farming, husbandry, processing agriculture and aquaculture products and salt production of cooperatives, income from license transfer for waste reduction. | 4-7 years tax exemptions for non-pioneer activities. | 10 years for investments that are setup in SEZs and with a minimum investment value of US$7 million. |

| 2. Tax holidays | – Maximum CIT exemption of 4 years. – 50% CIT reduction of 9 years (depending on the projects). | – 6-8 years tax holidays for pioneer activities and projects in less developed areas. | – 50% or 100% CIT reduction is available for 5 to 20 years from the beginning of commercial production, depending on the value of the planned investment. |

| 3. Reduced CIT rates | – 10% CIT rate for 15 years, which may be extended to up to 30 years for large-scale projects or those using new or high technology, provided approval of the prime minister is obtained; and a 4 year tax holiday, followed by a 9 year 50% reduction in the corporate income tax base. | – Exemption for 4-8 years for companies located in the export processing zones (35% CIT standards). | – CIT can be reduced by 30% of realized investment spread over a 6 year period (i.e., 5% per year) (25% CIT standard). |

| 4. Carrying forward losses | Corporates can carry their loss up to 5 years. | Losses may be carried forward for 3 years unless the taxpayer benefits from a tax incentive or exemption. | Conditional based on certain specific criteria and/or specific sectors. |

| 5. Import duty and VAT exemptions | Goods imported from overseas and used inside non-tariff zones and vice versa, as well as goods transacted among non-tariff zones are not subject to import duty or VAT. | Tax & duty-free importation of capital equipment & raw materials for zone enterprises; tax credit on raw materials & supplies for registered firms. | Exemptions & reduced import duty & VAT rates on inputs in certain sectors especially exporters. |

| 6. Investment allowances and tax credits | – Industries with high percentage of women workers. – Industries with high percentage of ethnic minority workers. – Deductible expenses of up to 10% of annual taxable income for science and tech R&D. | Tax credits for purchases of domestic breeding stocks & genetic materials. | Reduction of taxable income by up to 30% of investment in priority sectors. |

| 7. Accelerated depreciation | The maximum rate cannot exceed twice the ordinary rate of depreciation. | Immediate expensing of major infrastructure investments by export enterprises in less developed areas. | Doubling of depreciation rates in favored zones and sectors. |

| 8. Promoted activities | Hi-tech industries, industries using hi-tech manufacturing techniques, hi-tech technology transfer, certain prioritized/ encouraged sectors | Pioneer activities (new manufacturing industries; agricultural, forestry and mining industries of national interest; industries using new technologies); projects in less developed areas; project expansion or modernization; export industries | Pioneer industries: 1) basic metal industry; 2) oil refinery; 3) machinery industry; 4) renewable energy industry; 5) telecommunication equipment industry) |

| 9. VAT exemption | There are 25 types of goods and services which are exempted from VAT (certain agricultural products; financial derivatives and credit services; certain insurance services; medical services; teaching and training; printing and publishing of newspapers, magazines, and certain types of books). | For purchases of raw materials and supplies used in the manufacture and which form part of the registered export product | VAT exemption on the imports/purchase of machines and equipment (excluding spare parts) that are directly used to produce VATable goods, applicable in free zones and bonded zones |

| 10. Reduced VAT | 5 percent VAT rate applied for essential goods and services (such as water, fertilizer, medicine, educational equipment, etc). | ||

| 11. Land tax exemption | Exemption from land rental fees for a prescribed period, depending on the location or scale of the project. |

Mahan company Ltd offers a #1 Stop service for FDI consultancy and company registration. We also offer marketing and operations management, business expansion, M&A and consultancy services for exit stratergies. To find out more about our services from us please click here.

Disclaimer

This article provides information of a general nature based on current Vietnamese laws, regulations in effect as of the publication date and other information credible information in the public domain. For specific circumstances, readers should seek proper advice and/or contact the Mahan team at contact@mahan-vn.com-vn.com.